Key Growth Drivers for the U.S. Fasteners Industry

While fasteners are embedded across nearly every segment of the U.S. economy, their growth trajectory does not always align with broader GDP trends. In the current environment, factors such as sector-specific momentum, industrial policy, and supply chain realignment are contributing to strong demand signals. These dynamics point to meaningful growth potential for the fastener industry in the years ahead.

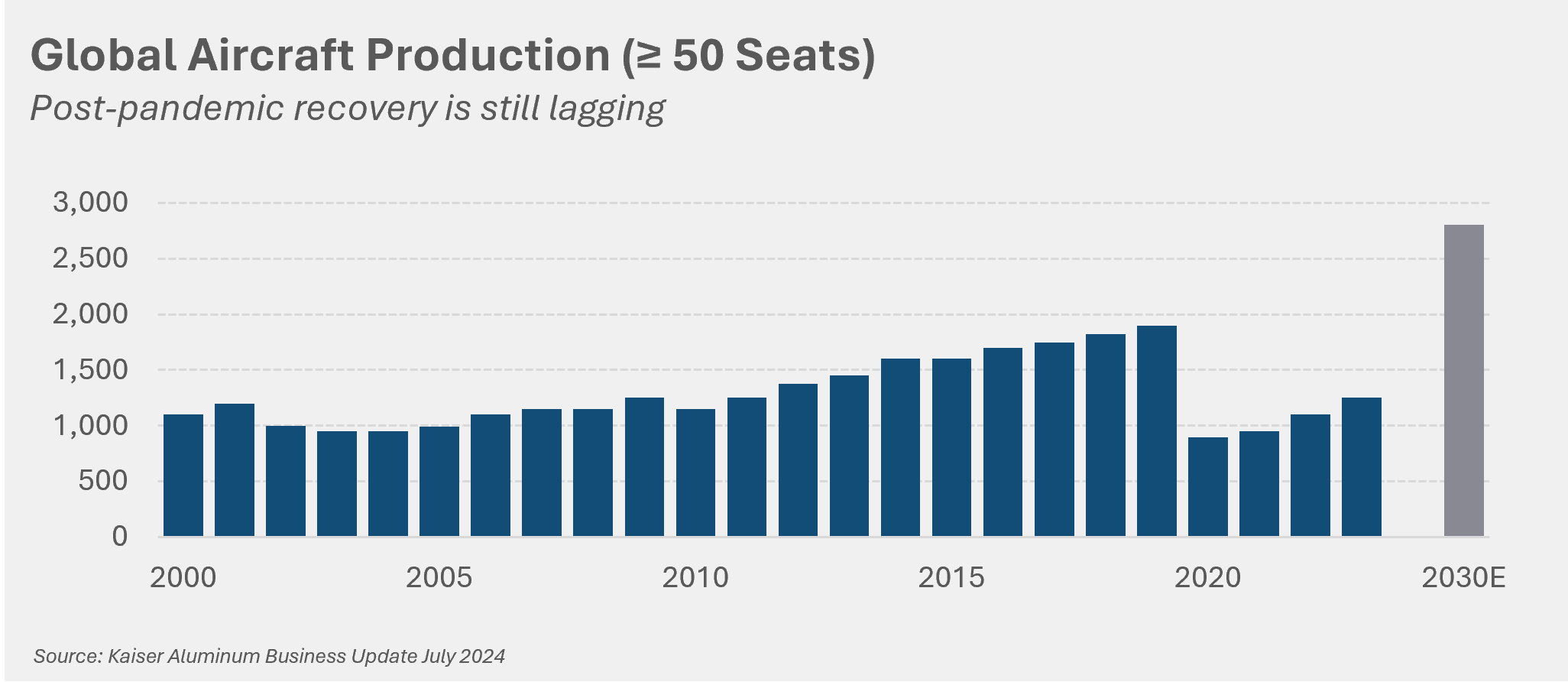

Aerospace Recovery Signals Growth for Fastener Suppliers

Fasteners are a critical component in the aerospace manufacturing industry, ensuring structural integrity and safety of aircraft. Growing demand for air travel and modernization of aging fleets are expected to propel the growth of aircraft production. Although the post-pandemic recovery has been challenging – amplified by well-publicized Boeing issues – production is expected to reach all time highs by the end of the decade, reinforcing a strong outlook for fastener businesses supporting the aerospace market.

Electronics Innovation Drives Steady Demand for Specialized Fasteners

The widespread incorporation of digital and connected technologies continues to drive significant increases in the demand for electronic components. The ubiquitous nature of these components fuels a continuous need for specialized fasteners for secure assembly. Unlike more stable components, growth in electronics is amplified by technological innovations that necessitate upgrades and compress the timeframe of replacement cycles. Growth in data center construction has a multiplier effect because fasteners are utilized within the exterior/interior structures and the technology equipment filling those data centers.

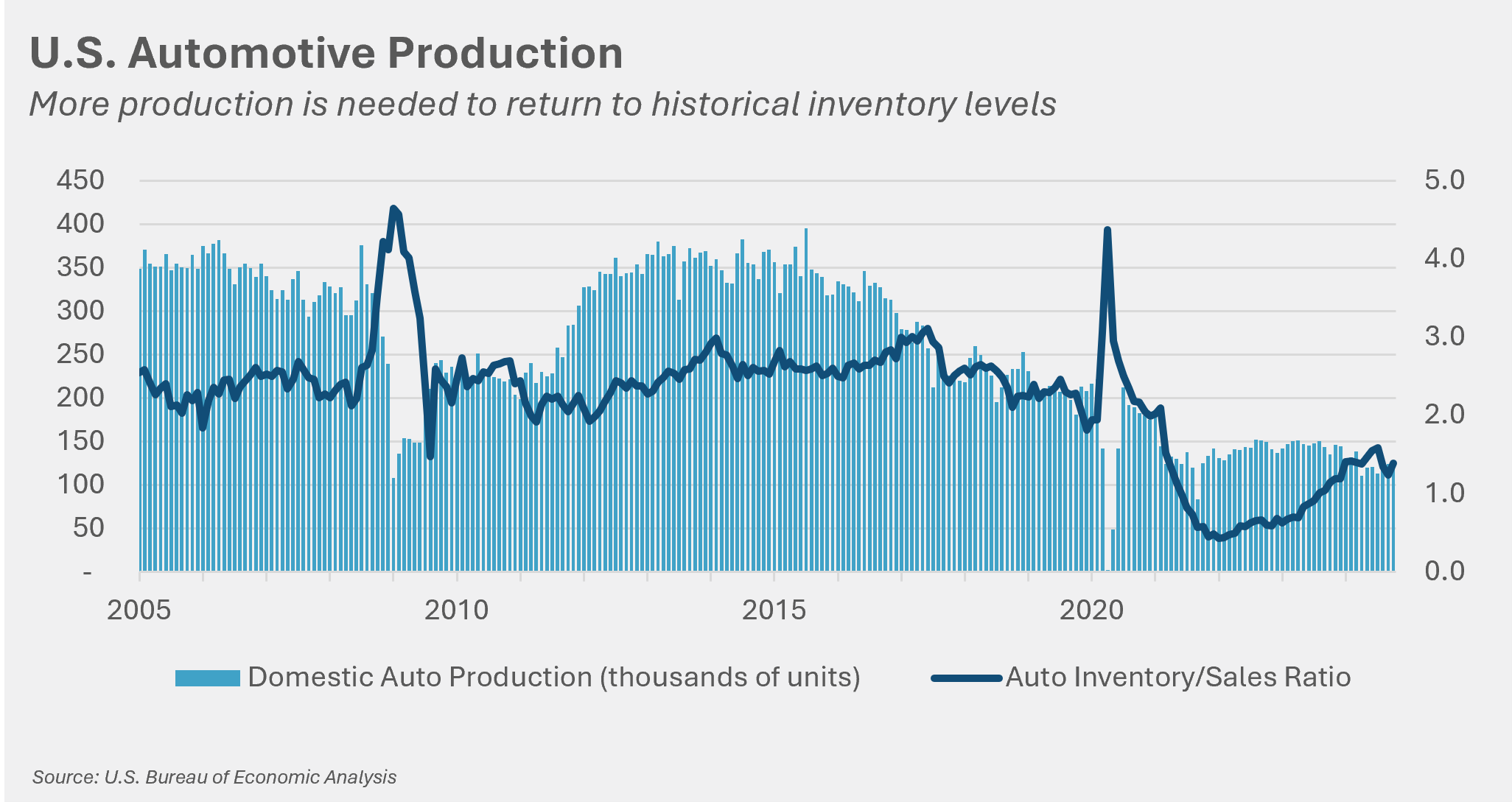

Electric Vehicles and Catch-Up Production Expand Market for Fasteners

Like aerospace, fasteners also play a crucial role in ensuring vehicle integrity and safety. U.S. automotive production has experienced a steady decline over the last decade as global competition has taken share. The acute impact of the pandemic created a supply/demand imbalance that has yet to fully recover. Given the auto inventory to sales ratio has hovered above 2x for the better part of the 21st century, there is still a need for catch-up production to build back up inventory levels – a factor that should support steady growth for fasteners in the automotive segment. Additionally, the continued adoption of EVs has the potential to expand the addressable market for fasteners. According to Stanley, EVs utilize significantly more fasteners than their ICE counterparts. Due to increased weight of the battery systems, innovation with lightweight materials has become a relevant factor for fastener manufacturers.

Reshoring Accelerates Demand for U.S.-Based Fastener Suppliers

In the years following the pandemic, supply chains became strained. OEMs found that in their pursuit of the lowest possible cost, they had inadvertently assumed increased supply chain risk. Those risks became reality as lead times tripled and, in some instances, production lines were forced to shut down. As a result, many OEMs refocused sourcing efforts to prioritize domestic suppliers. This not only decreased shipping times but also reduced exposure to freight costs and port closures. Momentum shifting back to the U.S. is already underway, and policy may accelerate the trend as the threat of tariffs will continue to incentivize U.S. production. The Inflation Reduction Act (IRA), Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act and the Infrastructure Investment and Jobs Act (IIJA) have driven a boom in factory construction in recent years, and the U.S. manufacturing sector is poised to capitalize on these shifting trends.

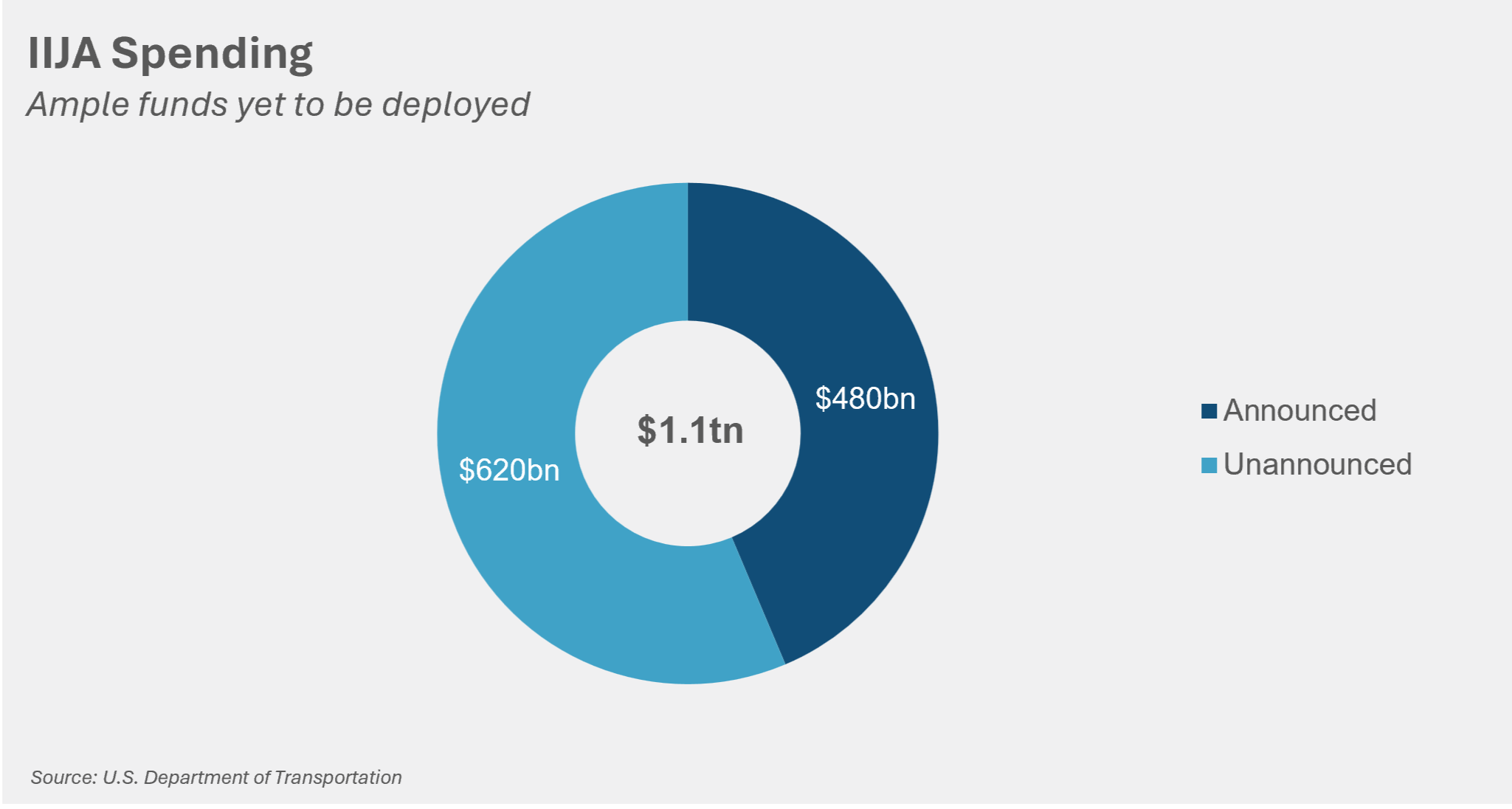

Infrastructure Funding Unlocks Growth for U.S. Fastener Industry

Several large legislative bills were passed in recent years, each designed to strengthen U.S. infrastructure, industrial capacity, and economic competitiveness. In particular, the Infrastructure Investment and Jobs Act (IIJA) authorized $1.2 trillion in transportation and infrastructure spending. The bill is wide reaching and many of the projects (bridges, buses, airports, energy projects) will drive fastener consumption throughout the U.S. As of September 2024, less than half of funding had been announced and even less had been spent. Domestic sourcing requirements have contributed to the slow deployment, as has decreased purchasing power due to inflation. “Use it or Lose it” stipulations should accelerate spending in the final years of the bill, and “Buy American” requirements should benefit U.S.-based fastener manufacturers and their related distributors.

Want more insights into the Fasteners Industry?

Looking to explore strategic options in the Industrials sector?

Connect with Dustin Ramsey, Director at Mazzone & Associates. Whether you're considering a sale, acquisition, or capital raise, Dustin brings deep industry knowledge and transaction expertise to help you evaluate your next move with confidence.